2 Approaches to Calculating Life Insurance You Need in Singapore

There are mainly two ways of estimating insurance needs in Singapore, namely the (1) Human Life Value Approach and (2) Needs Approach.

Human Life Value Approach

First of all, let’s talk about the Human Life Value Approach. Simply put, it is all about understanding the “time value of money” before calculating how much life insurance you actually need in Singapore.

The human life value approach involves calculating a person’s human life value by turning the person’s expected future earnings into a present value. Why the present value? That is because from a financial perspective, money has time value. The $1SGD million you get today is more valuable than the $1SGD million you will get in 10 years.

Many people misunderstand the relationship between inflation and the time value of money. In fact, it’s not because of inflation that today’s money is more valuable than the same amount of money in the future. Instead, it’s because you can do much more with the $1SGD million if you have it now rather than 10 years later.

This period of time over which you can earn more interest on your money is the time value of money. The expected rate of return on investments during this period is the discount rate or discount factor.

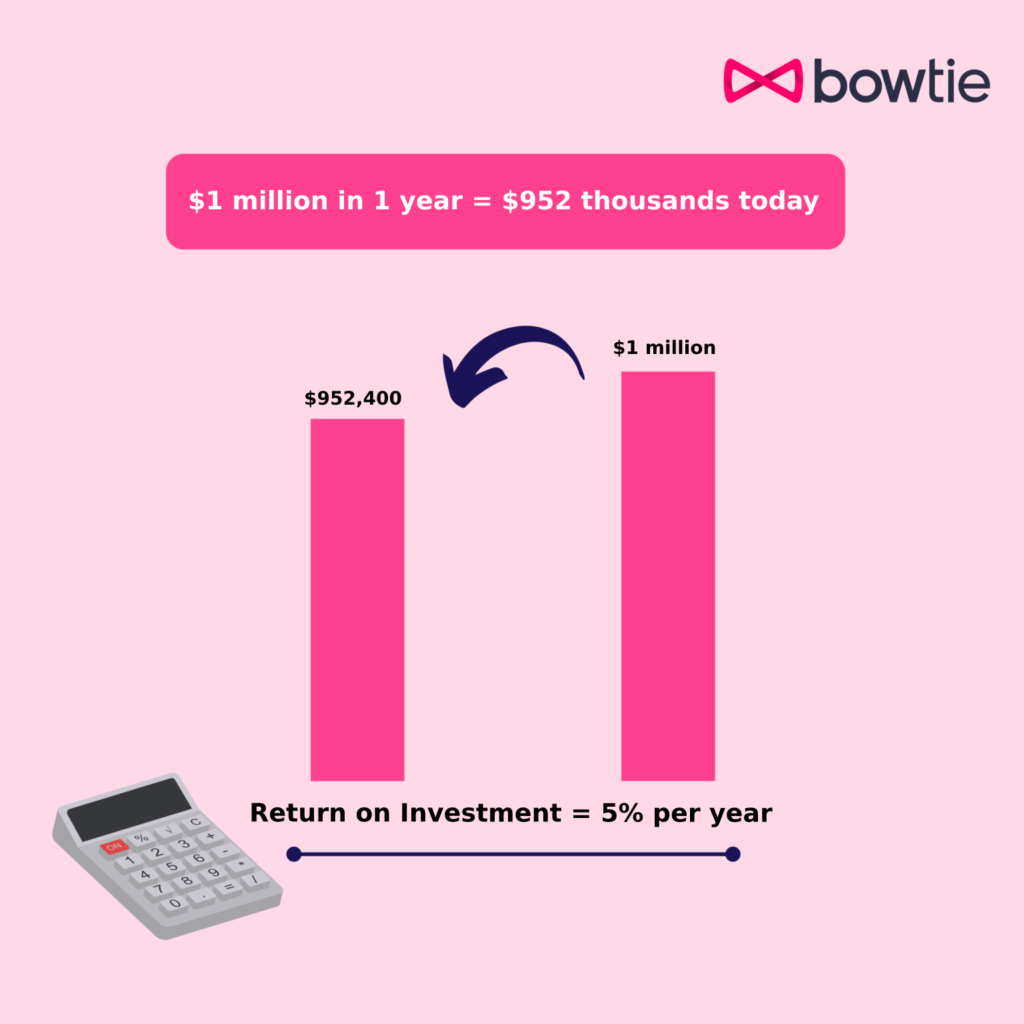

For example, if someone is supposed to receive $1SGD million in 1 years, but is given the money today instead, and the person anticipates that the expected return on investment would be 5% per year. As long as he owns $952SGD thousands today, the value is equivalent to $1SGD million after a year.

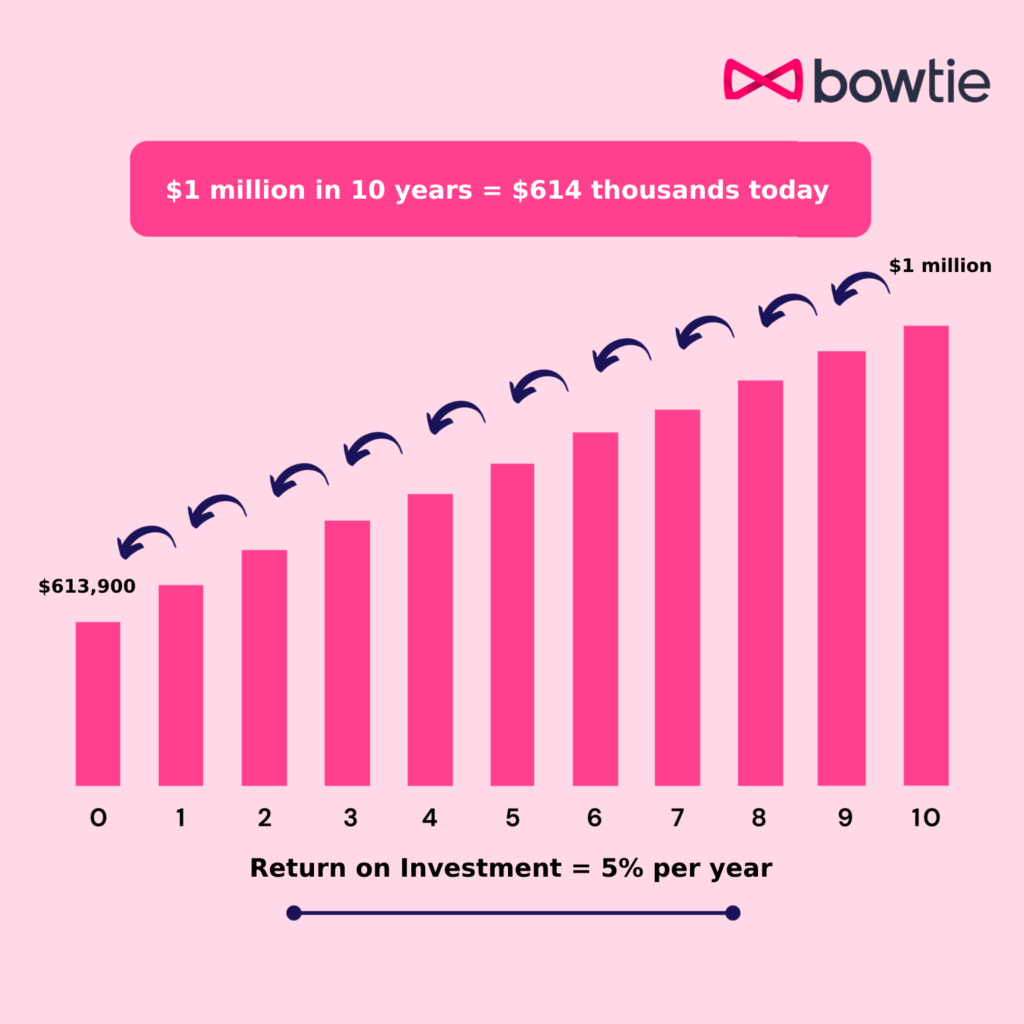

Similarly, if someone is supposed to receive $1SGD million in 10 years, but is given the money today instead, and the person anticipates that the expected return on investment is also 5% per year, then the present value of a $1SGD million payment in 10 years would be calculated as $613,900SGD (100/1.05^10).

In other words, the value of $613,900SGD today is equivalent to that of $1SGD million in 10 years.

Human Value Life Approach - Calculation Example

The discount rate varies from person to person, but more conservative principles are generally used when calculating the amount of life coverage, such as using a bank’s Certificate of Deposit (CD) rate as the discount rate in Singapore.

For example, a 30-year-old person has an annual income of $300,000SGD with an annual growth rate of 4%, and is expected to retire at the age of 65. Assuming the discount rate is 1.5%, then the human life value of this person is $17.07SGD million.

If you are interested in calculating how much life insurance coverage you need from the Human Value Life Approach, you can enter data into a financial calculator or Excel to calculate the present value (PV).

Below table is the example:

| Cash flow (PMT) | -$300,000SGD |

| Number of periods (N) | 36 years |

| Net discount rate (I) | -2.40% |

| Future value (FV) | 0 |

| Present value (PV) | $17.07SGD million |

The net discount rate is negative because of the increase in income. The formula is 1.015/1.04-1. A rough estimate can be derived, but it does not take into account such factors as family responsibilities, existing assets and liabilities, etc. Therefore, this method of estimation might not be the most accurate to some Singaporeans.

Needs Approach

Needs approach allows us to calculate the amount of life insurance needed according to the actual financial status.

The Needs Approach takes into account the actual needs and financial situation of the insured by evaluating their personal and family responsibilities, including caring for a child or parent. These expected future expenditures are then converted into a present value, plus current liabilities such as outstanding mortgages and other expenses such as funeral expenses and more. On the other hand, current existing assets include deposits and other investments, etc. are then subtracted.

When determining the necessary amount of life insurance in Singapore, self-occupied property is usually not included in current assets. The reason why is because unless someone passes away and the family decides to sell the self-occupied property to cash out, the property can only be used as a residence and cannot generate a cash flow that contributes to daily expenses.

Moreover, if we were to consider the self-occupied property an asset in calculating the amount of coverage, it means that the property may be sold for cash when necessary. In other words, you would need to consider the rental expenses needed after selling the home and convert the future expenses into a present value. This would complicate the matter. Therefore, typically, a self-occupied property should not be taken into account when calculating assets.

Needs Approach - Calculation Example

Let’s use an example to illustrate the Needs Approach.

Suppose a 35-year-old man has a 3-year-old daughter. In the event of his own untimely death, he hopes to fulfill his responsibilities as both a husband and a father, including redeeming the mortgage and setting aside a certain amount of money for his daughter’s studies.

See the table below for details and calculations.

| Responsibility to support daughter (A) | ||||

|

Annual expenditure (SGD) |

Expected inflation | Number of years |

Present value (SGD) |

|

|

Kindergarten tuition and other expenses |

$120,000 | 4% | 3 | $368,940 |

| Primary school tuition and other expenses | $180,000 | 4% | 6 |

$1,098,547 |

|

Secondary school tuition and other expenses |

$228,000 | 4% | 6 | $1,271,225 |

| University tuition and living expenses | $600,000 | 4% | 4 |

$1,991,738 |

|

$4,730,451 |

||||

| Debt (B) | ||||

|

Mortgage |

$5,000,000SGD |

|||

| Other (C) | ||||

|

Funeral costs |

$300,000SGD |

|||

| Assets (D) | ||||

|

Cash |

$500,000SGD | |||

| Other investments |

$500,000SGD |

|||

| Life insurance needs (A) + (B) + (C) – (D) | ||||

|

$9,030,451SGD |

||||

It can be seen from this example that using the Needs Approach to calculate the necessary amount of life insurance is more accurate and more suited for the actual needs of the policyholder than the Human Life Value Approach.

However, before determining how much life insurance is enough in Singapore, the person concerned must clearly understand their needs and make use of more data for the calculation.

Which Type of Life Insurance Plan is the best?

Having said that, no matter which method you use, the life insurance coverage amount calculated is bound to be higher than what an average person might expect.

Are the above methods overestimating the amount, or do most people underestimate their actual life insurance needs? We’ll let you sleep on it.

In the meantime, we would like to bring out one more point: most people think that a $1.5SGD million life insurance is a lot, and this may be because traditionally, most life insurance products available are Whole Life Plans. In fact, a $1.5SGD million whole life insurance would indeed be more than enough and the premium is really expensive.

The main purpose of buying life insurance is to fulfill the responsibilities that you may not be able to carry out. The question is if these responsibilities are not for life, is it necessary to purchase life insurance that covers your whole life? Certainly, if you buy life insurance for other reasons, such as transferring wealth to the next generation, it’s a different story.

In fact, a $1.5SGD million Term Life Insurance Plan is definitely enough and affordable for most people. Given the limited time, we will discuss the difference between the Whole Life Plan and Term Life Plan next time.

FAQ

Life Insurance is a type of insurance that covers against death, terminal illness, and total permanent disability (TPD).

The sum assured of every life insurance policy is decided against the premiums you pay for a policy.

Normally, under the same conditions and with the same insurance product, the higher the sum assured, the higher the premiums.